Renters Insurance in and around Omaha

Your renters insurance search is over, Omaha

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected accident or trouble. And you also need liability protection for friends or visitors who might hurt themselves on your property. State Farm Agent Matt Dougherty is ready to help you navigate life’s troubles with dependable coverage for your renters insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Matt Dougherty can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Your renters insurance search is over, Omaha

Renting a home? Insure what you own.

Agent Matt Dougherty, At Your Service

The unanticipated happens. Unfortunately, the stuff in your rented property, such as a tablet, a couch and a bed, aren't immune to vandalism or break-in. Your good neighbor, agent Matt Dougherty, is dedicated to helping you understand your coverage options and find the right insurance options to protect your belongings from the unexpected.

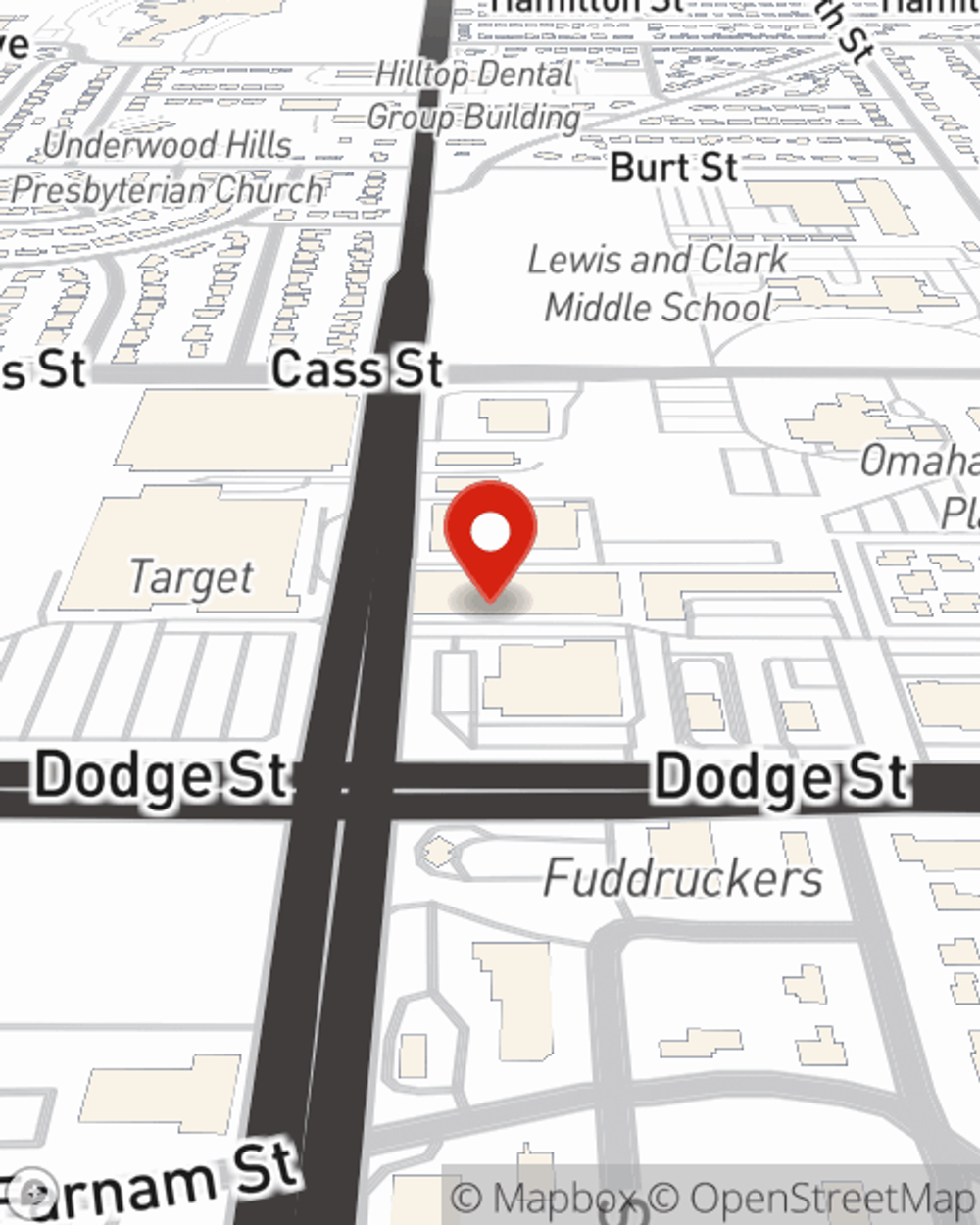

Reach out to State Farm Agent Matt Dougherty today to check out how the trusted name for renters insurance can protect items in your home here in Omaha, NE.

Have More Questions About Renters Insurance?

Call Matt at (402) 884-2870 or visit our FAQ page.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Matt Dougherty

State Farm® Insurance AgentSimple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.